Easy

ACH File Creator

The Easy ACH File Creator

is used to make a direct deposit file from the Forest

Products Accounting system. To access the Easy ACH File Creator

window, select the menu option entitled Easy ACH File Creator on the Fiber

Procurement Utilities Menu.

In order to use this option

you must purchase the Easy ACH File Creator from www.ezdd.com. They will

assist with installation and set-up of your company and banking information.

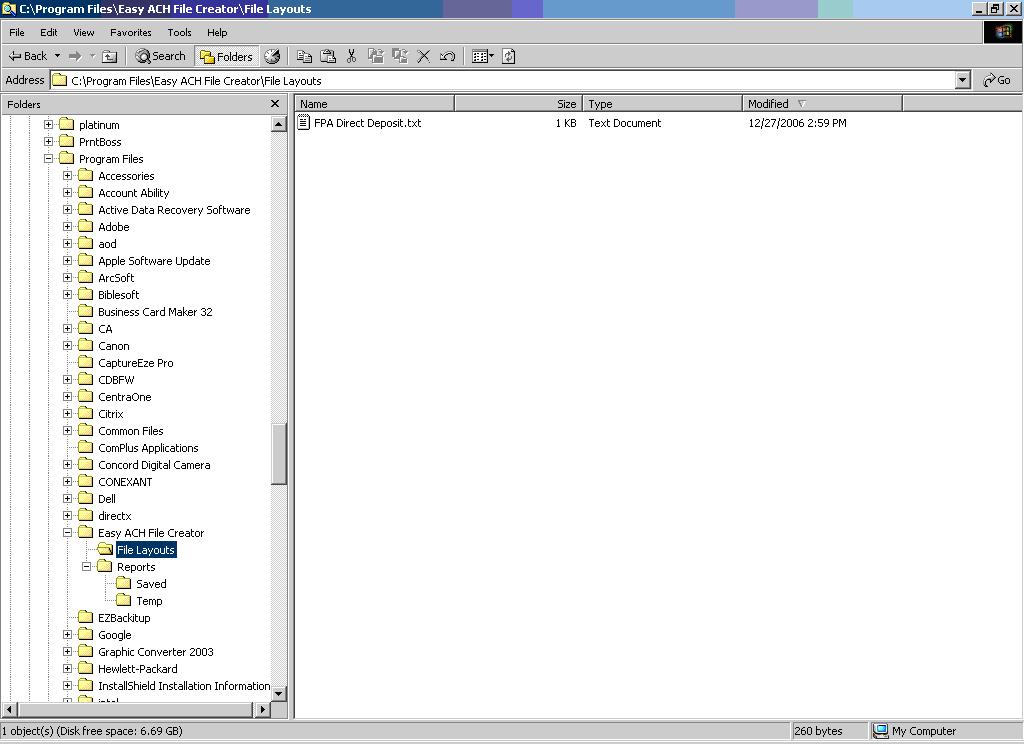

Once the Easy ACH File

Creator product is installed copy the file FPA Direct Deposit.txt file

from \fpa to \Program Files\Easy ACH File Creator\File Layouts. This

will establish the File Layout that will be used when importing the file

into Easy ACH File Creator. The

window below shows where the file should be copied.

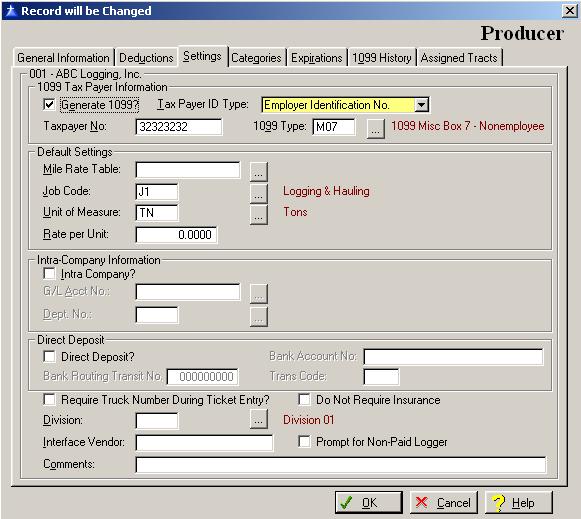

The producers, owners,

and vendors need to be setup for direct deposit. This will be done thru

File Maintenance - Producers, Owners, or Vendors. There is a check box

on the Settings tab as shown below:

Enter or edit the direct

deposit information according to the following specifications:

Direct

Deposit

Enter a check in the box

if the producer/owner is going to be paid by direct deposit. If the producer/owner

is going to be paid by check, leave the box unchecked. To place a check

in the box, click on the Direct

Deposit box,

or press the Space

Bar when the

selection box is positioned over the hold payment field.

Bank

Routing Transit No.

Enter the bank routing

transit number of the producer/owner's bank. The field allows for up to

nine numeric characters.

Bank

Account No.

Enter the producer/owner's

bank account number. This field allows for up to fifteen numeric characters.

Trans

Code

Enter a 22 in this blank

if the producer/owner's account is a checking account. Enter a 32 if the

account is a savings account.

To save and exit the Producer/Owner

window, press Page

Down, click

on the OK button, or press Alt

O. To exit

without saving the Producer/Owner window, click on the Cancel button, press Alt

C, press

Esc, or click on the X in the upper right corner

of the screen.

To access online help,

click on the Help button, press Alt

H, or press

F1.

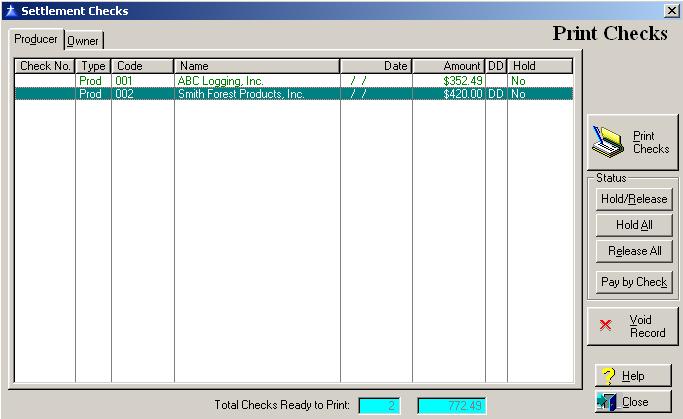

Process Settlements and

Vouchers as normal. Go to Print Checks. Physical

Checks and Direct Deposits can be processed together. There is now a column

in Print Checks that will indicate the checks that will be processed as

Direct Deposits. See

the example below:

Pay

by Check

This button becomes available

when the highlighted check is being paid with direct deposit. It is a

one-time override to pay by check. To pay by check, click on the Pay

by Check button,

or press Alt K. To swap back to direct

deposit, click on the Direct

Deposit button,

or press Alt D.

When checks are processed

it will prompt you when to load checks and when to load plain paper for

the Direct Deposit receipts and Direct Deposit Check Register. During

this process, a Direct Deposit export file is created and copied to the

\fpa\dataxx\ExtInterface folder. The

name of the file is DirectDeposit.txt. Direct Deposits will

appear on all Check Registers and will also appear under Void Checks.

They will

have a system assigned Check No..

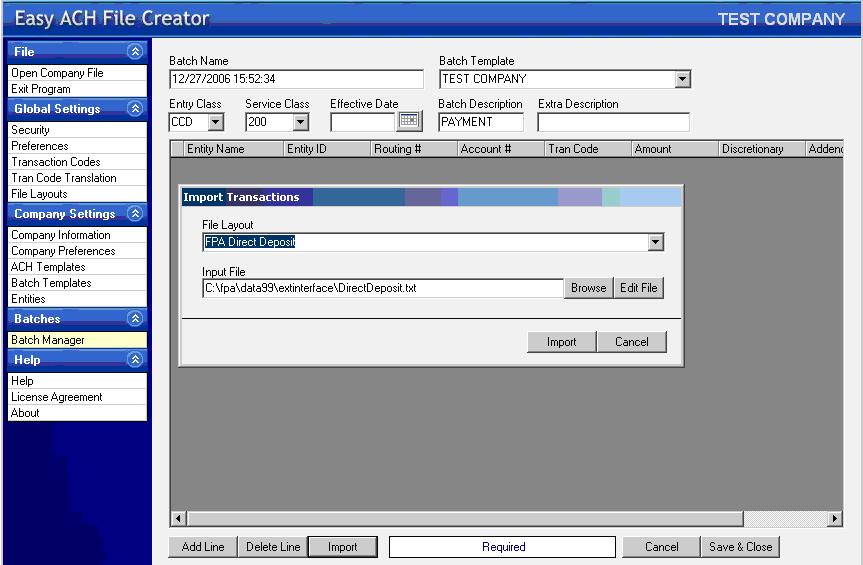

Once the file is created

you will need to select the menu option entitled Easy ACH File Creator

on the Accounts Payable Utilities Menu. This will take you to the application

to create the file to send to the bank.

Select Batch

Manager from

the options on the left of the screen. Click on New at the top. Click on Import at the bottom. Then choose

From

File.

Select FPA

Direct Deposit

from the File Layout section. Browse to the DirectDeposit.txt file from server\fpa\dataxx\extinterface folder. Click Import. The

data from FPA will now be imported into the batch file. You must select

an Effective

Date for the

Batch, then Save

& Close.

Follow instructions that you received from the Easy ACH File Creator software

vendor as to processing this file and transmitting to your bank. If you

need assistance with the Easy ACH File Creator product, please call (360)891-6174.

When you close out of the

Easy ACH File Creator, the system then verifies if all the direct deposits

were posted to the file correctly. If they posted correctly, click the

Yes button. If any

of the direct deposits did not post correctly, click the No

button. If you selected no, the system leaves the direct deposits out

there to create another file.

Return

to Top

1099

Export

Account

Ability Tax Preparation Software

Return to Utilities